By Oliver Nichols, Director of Research & Development, RLB in Oceania and Trent Wiltshire, Research & Development Manager, RLB in Oceania

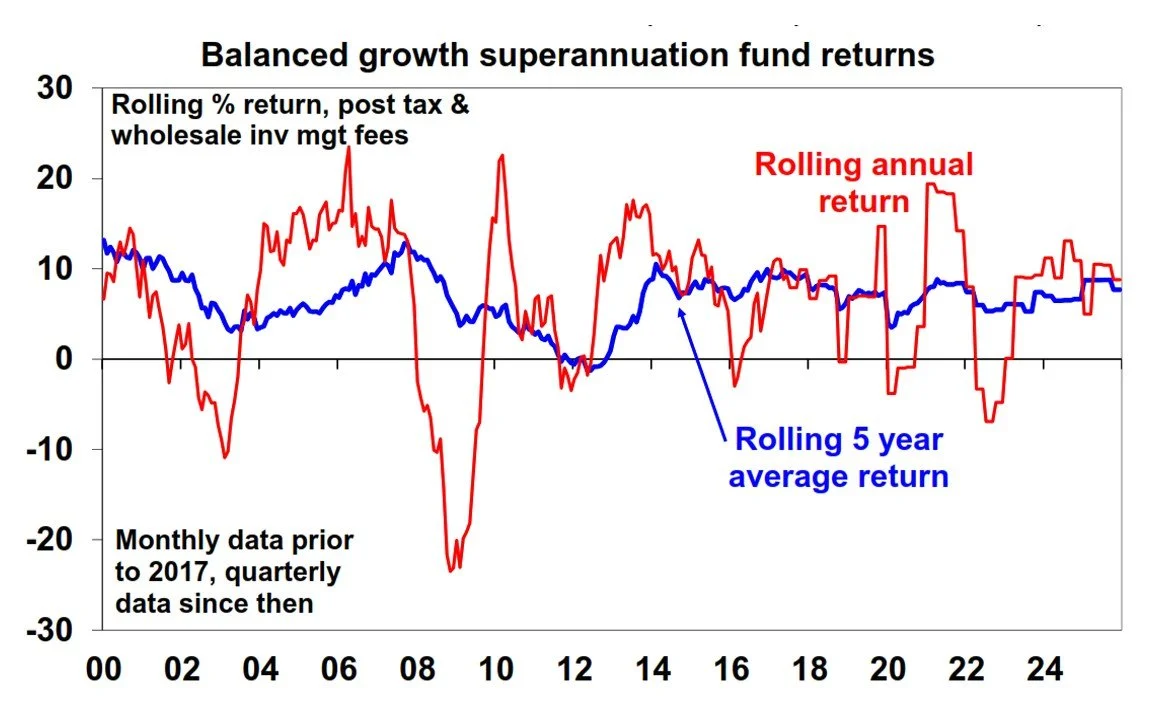

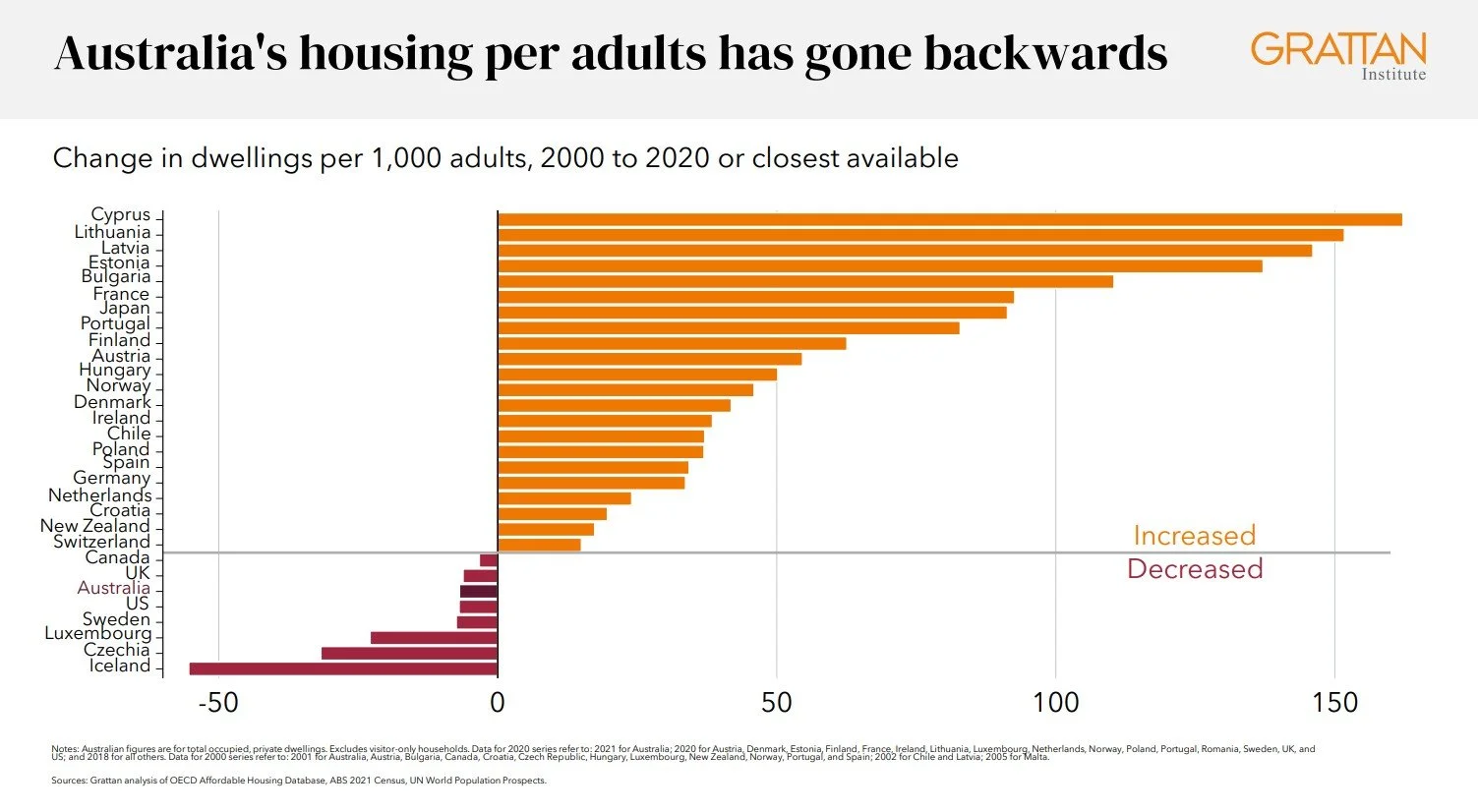

Australia entered 2026 with construction activity at historically high levels, driven by growth in engineering construction – mainly energy infrastructure such as transmission lines, solar, wind and pumped hydro. There has also been a pick-up in apartment construction activity, boosted by lower interest rates and government policy changes aimed at increasing the supply of apartments and townhouses.

The pipeline of construction activity is also robust, especially in public infrastructure, defence and energy projects. Order books are particularly strong in Western Australia, South Australia and Queensland.

New Zealand is earlier in the cycle, with activity lifting slightly through 2025. The early uplift is residential-led, with growth strongest in apartments and townhouses. Activity has picked up most in Auckland and Canterbury. Non-residential demand remains subdued – particularly in healthcare, social buildings and retail – despite pockets of strength in some regions, notably Wellington and more recently Auckland.

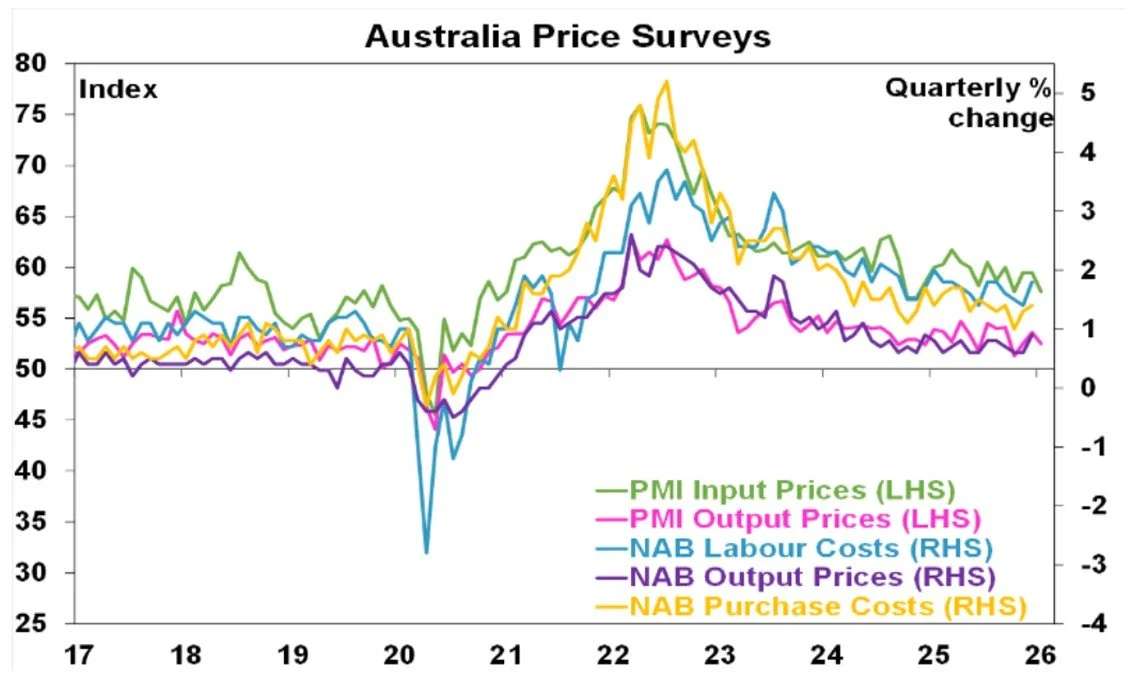

Overheated market maintains pressure on costs

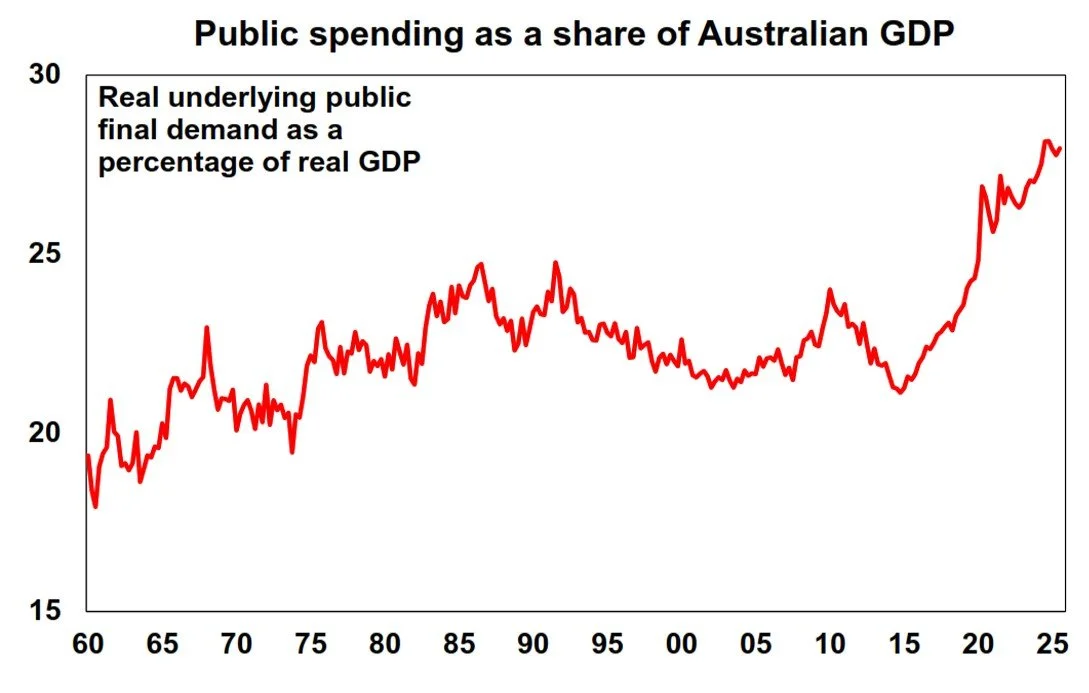

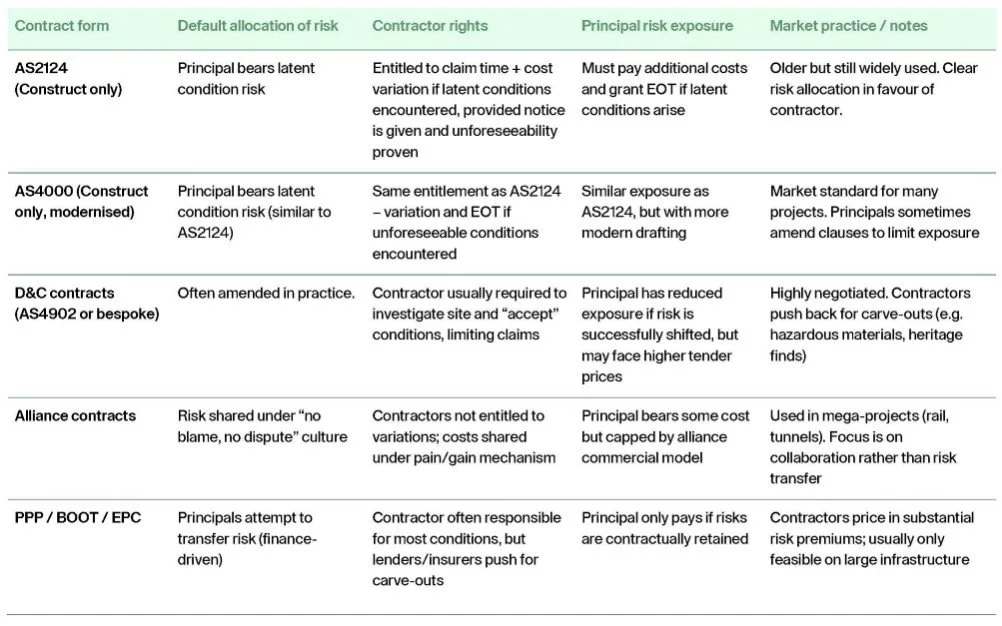

Construction cost escalation eased across most of Australia in 2025, but the Tender Price Index is still growing at a faster pace than pre-pandemic. The high volume of work underway will keep the market overheated, maintaining pressure on construction costs and delivery timelines. A lack of competition among Tier 1 contractors and subcontractors on large-scale projects, the risk of builder and subcontractor insolvencies, sluggish productivity, and high levels of public sector activity, are also combining to keep costs elevated.

Construction cost growth is expected to increase during 2026 and 2027 in Brisbane, the Gold Coast and Townsville as Olympic construction and government initiatives ramp up. Construction cost escalation is also forecast to rise in Adelaide and increase modestly in Sydney from 2027.

In contrast, pricing remains comparatively subdued in New Zealand, reflecting the softer conditions. TPI growth in all major cities is expected to pick up from the very low escalation rates of 2025. Levels of escalation across the main cities in New Zealand are forecast to be in the range of 0.5% to 2.5% for 2026.

There is a strong near-term pipeline of work in Australia. In the building sector, approvals, work yet to be done, commencements, and work under construction are all at decade-highs.

“The high volume of work underway will keep the market overheated, maintaining pressure on construction costs and delivery timelines.”

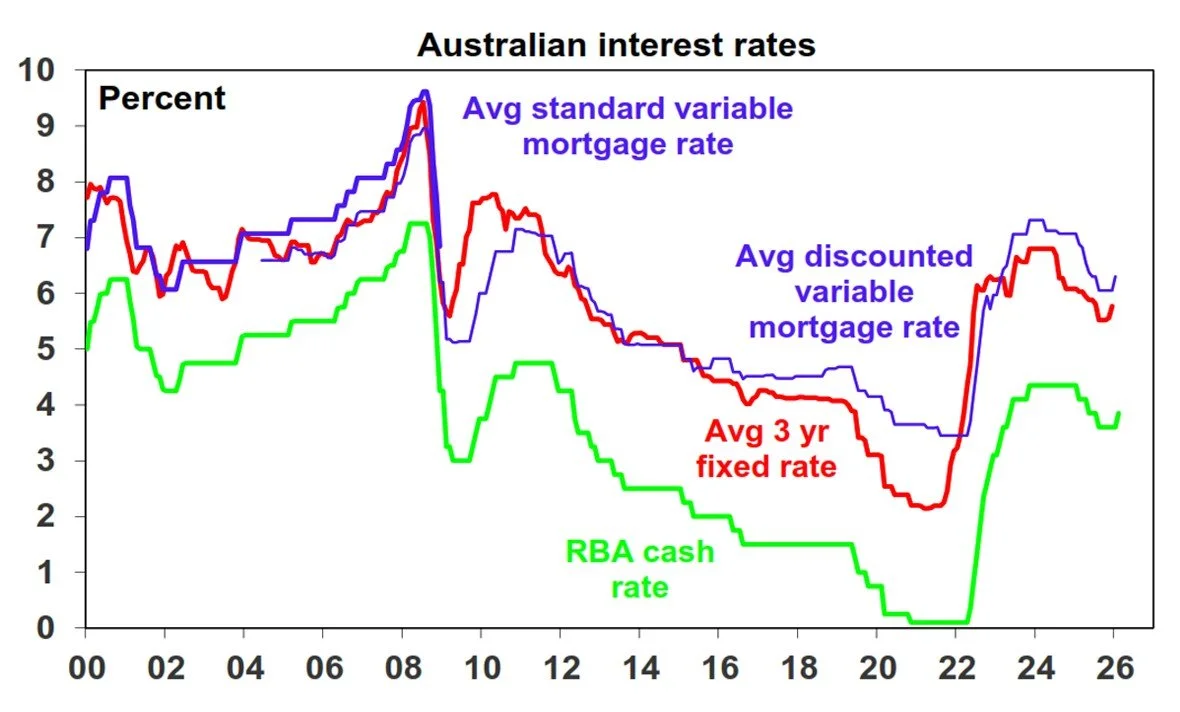

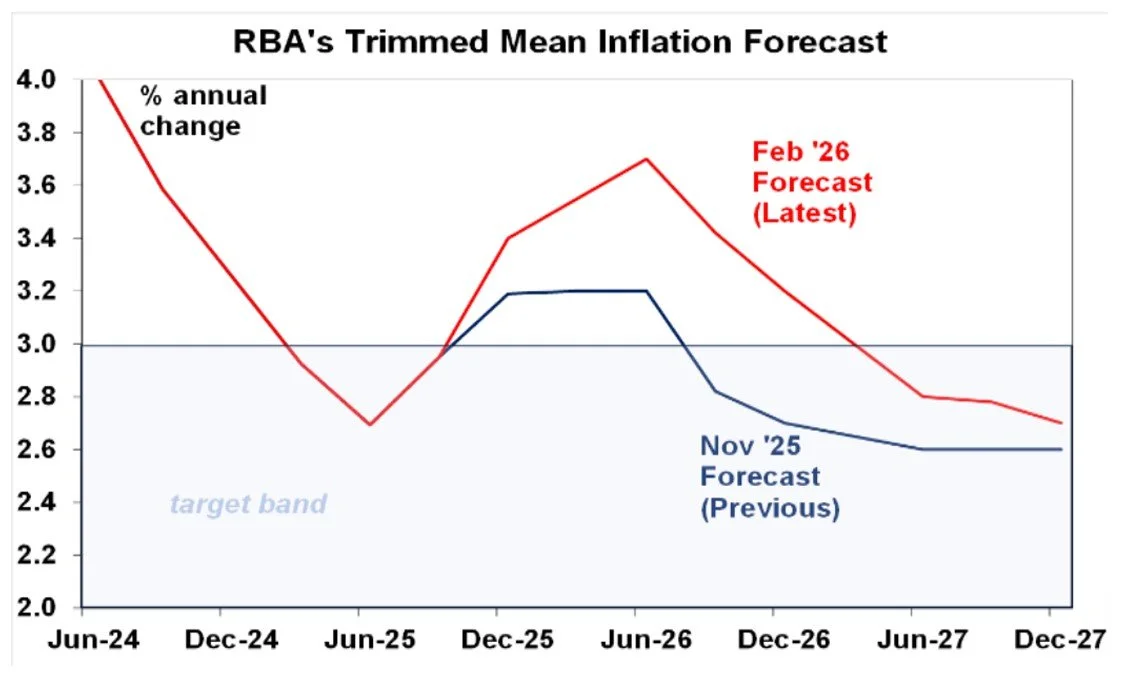

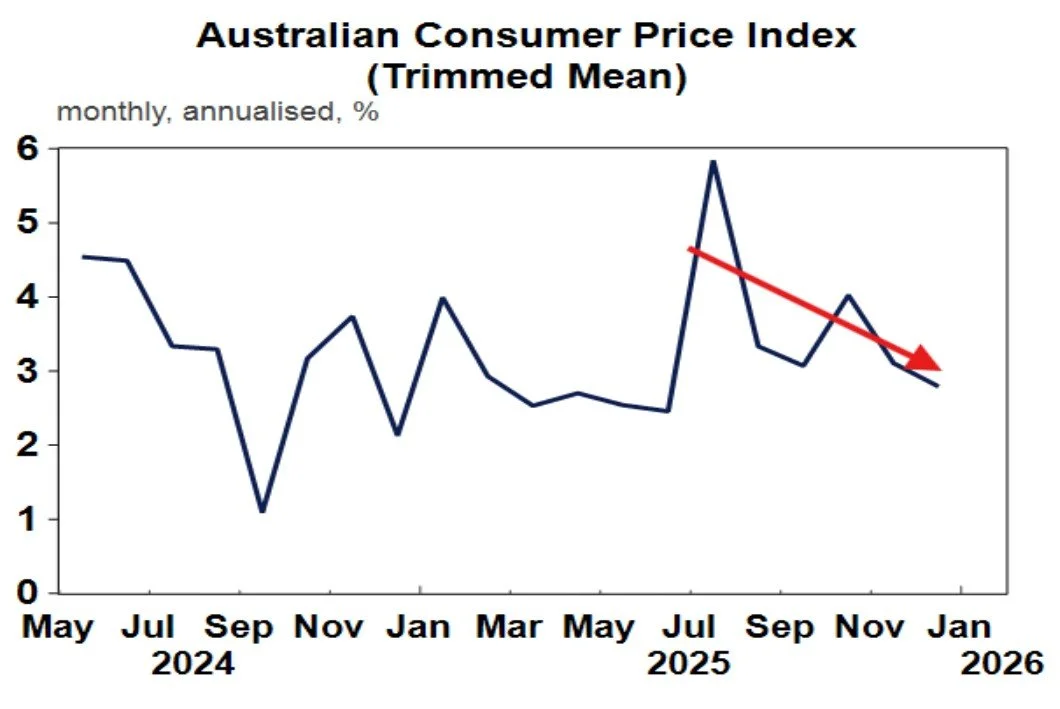

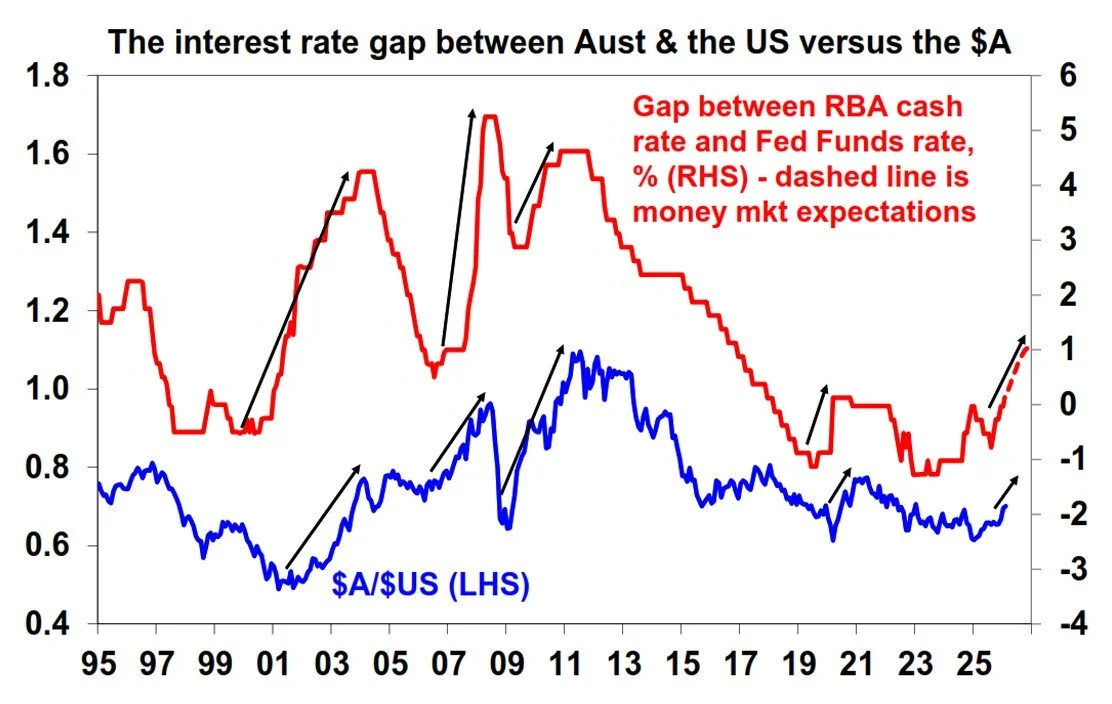

Prospect of higher interest rates clouds outlook

The longer-term outlook in Australia has become more uncertain. The Reserve Bank of Australia raised interest rates in February and further increases are expected in the year ahead. Higher interest rates are likely to dampen construction activity in the short to medium term, particularly in interest-rate sensitive markets such as high-density residential.

Ongoing skilled labour shortages and sluggish productivity are expected to continue pushing up wage costs. At the same time, a transition in the public infrastructure pipeline, from transport toward utilities, energy and other sectors, may not occur smoothly. State government policies aimed at boosting apartment and townhouse construction could support residential volumes but are also likely to add to cost escalation.

In New Zealand, there are tentative signs of a recovery in construction activity, led by residential construction. Lower interest rates are the key driver of the expected recovery – the Reserve Bank of New Zealand cut the official cash rate from 5.5% in August 2024 to 2.25% in November 2025. Stronger population growth will also support demand, but any rebound is likely to be uneven and sector specific.

This article has been republished with permission from RLB. Explore more of the RLB 2026 analysis of global construction trends here.