JLL is a world leader in real estate; buying, building, and investing in a variety of assets including industrial, commercial, retail, residential and hotels. The company gives insight into how greening goals are being imagined in real estate.

Leading cities are now setting goals to tackle carbon throughout a building’s lifecycle…

Decarbonizing cities will take more than cutting carbon emissions from buildings operations.

As cities commit to ambitious net zero targets, the most progressive among them are now considering how they can better plan building lifecycles, from construction to maintenance and ultimately, demolition. The construction industry is the world’s biggest producer of waste. In the EU, construction and demolition waste accounts for approximately one-third of total waste, and around 40 percent of solid waste in the United States.

That needs to change – and quickly – if cities are to achieve a net zero future. It’s why circular economy thinking, which aims to eliminate waste, is growing in popularity. It has profound implications for decarbonizing cities because it factors in whole-life emissions – the carbon generated by producing and transporting materials through to their use and disposal.

“Circular economy principles are about preserving the value of assets by embedding zero-waste thinking early in the lifecycle and designing with reuse or repurposing in mind,” says Cynthia Curtis, SVP and Corporate Sustainability Officer, Americas at JLL. “They redefine the concept of waste, recognizing the value in the materials. Reducing the carbon emissions of planned new buildings can significantly help the transition to net zero.”

However, that’s only part of the solution. In North America and Europe, for example, around 80 percent of buildings that will be in use in 2050 already exist today and will fall far short of future carbon reduction targets. Yet knocking down an old building to build a new, greener building, is not an effective approach.

“Retrofitting older buildings is so important; the carbon has already been spent in creating that structure,” adds Curtis. “Through reuse and repurposing, the spent carbon can be leveraged more efficiently.”

Regulations on the horizon

Incoming regulations in major cities are increasingly front of mind for developers. Amsterdam will halve the use of new raw materials by 2030 on the road to being fully circular by 2050.

Los Angeles is aiming to be the largest city in the U.S. to achieve zero waste, targeting a 90 percent landfill diversion rate by 2025, while Melbourne is also on a similar path.

Paris, which wants 50 percent of construction sites to send no waste to landfill by 2030, is leading the way with Design for Reuse Principles. These encourage developers to focus on projects that can accommodate different functions over time – housing, offices, hotels – without the need for renovations or major upgrades. By 2030, 30 percent of its office stock will need to be adaptable.

“The principle of reuse has a much wider context than simply decarbonization – it’s about being able to respond to changes in the future of work or in social patterns,” says Jeremy Kelly, Global Research Director, City Futures at JLL. “It addresses how the value of assets can be maximised over the long term, and how our building stock can be better managed.”

New materials drive progress

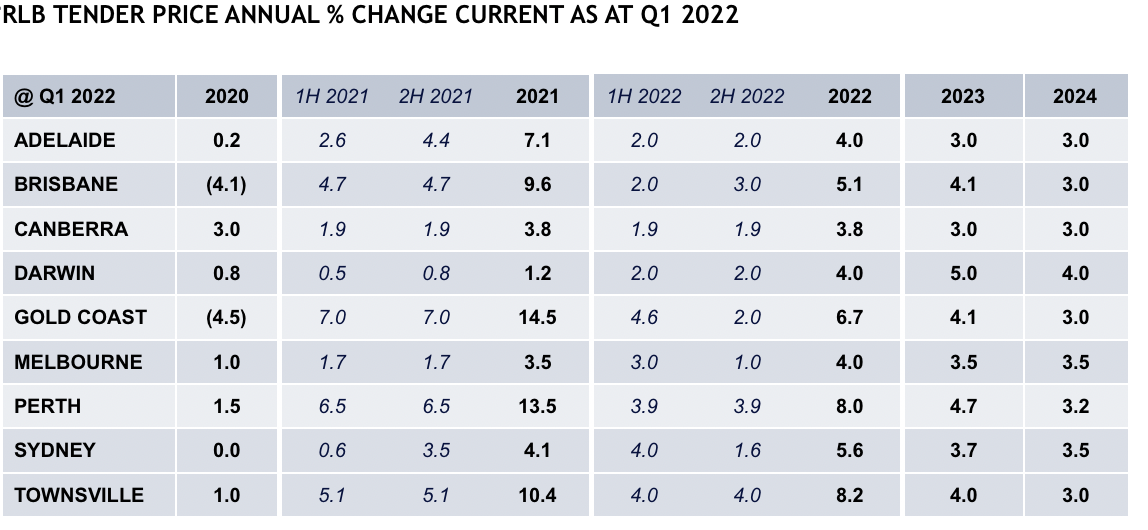

Ongoing shortages of construction materials have also contributed to a growing awareness of the need for circular principles in real estate.

“We’ve seen a significant increase in client inquiries about waste management strategies,” says Curtis. “Waste reduction is a direct precursor to a circular economy because the most effective method is to design for reuse at the outset.”

At the same time, there’s a growing range of reusable materials supporting circular construction, such as Cradle to Cradle (C2C) products that can be returned to manufacturers for repurposing.

Carbon-negative materials including mycelium insulation and certain bioplastics remove carbon from the atmosphere during production. Innovations in manufacturing have also led to carbon-neutral concrete and lower-carbon steel.

A new generation of sustainable developments are spearheading such products. Amsterdam’s mixed-use Park 20|20, which features one of the world’s largest collections of C2C materials such as reusable structural frames, is one of the protagonists.

In Hamburg, Landmarken AG is currently building Germany’s first residential complex where more than 50 percent of materials were selected with reuse in mind – and many are Cradle to Cradle certified. Schemes like London’s Whole Life-Cycle Carbon Assessment and Paris’ RE2020 will encourage more such developments in the coming years.

“Cities with regulations to encourage considerations of whole-life carbon and building adaptability see greater traction more quickly,” says Curtis.

Regulation lags market forces

Despite the headline actions of leading cities, legislation is lagging in many others. Market pressure from businesses who increasingly seek low-carbon, low-waste spaces is having a greater impact, says Kelly.

One challenge is that the cost of circular design can initially be higher, but it can cover several traditional building lifecycles.

The lack of financial incentives, education and regulatory guidance can also make it more difficult for businesses to adopt a circular mindset, notes Curtis, holding back the industry-wide change necessary for circular construction.

“The building lifecycle involves many players – investors, developers, architects, manufacturers, contractors and suppliers,” says Kelly. “To embed circularity in this complex value chain requires much deeper collaborative business models. And we need this transition to drive the sustainability progress that’s paramount for the built environment.”

This article was originally published on JLL’s website, read it here…