Author: Alex Cox, Practice Leader, Bellrock Advisory

Whilst losses from natural perils like flood, cyclone and fire fill the headlines, there is a silent risk which is derailing civil construction in Australia. This silent threat is latent conditions.

“A latent condition is a physical condition on or near the site that could not reasonably have been anticipated by an experienced contractor at the time of tendering.”

Common examples of potential latent conditions include:

Contaminated soil such as asbestos or PFAS; which contributed to the 2 year delay of The West Gate Tunnel in Victoria.

Below ground conditions (e.g. sink holes, cavities, fault lines); sink holes and a reverse fault line have contributed to the 3 year delay of Sydney’s M6 Motorway. Sinkholes were also to blame for the 2 year delay to the Forrestfield Airport Link tunnel in Perth.

Concealed building services, such as power, water, data, cabling or other features (whether active or redundant) hidden behind walls, above ceilings or below floors; and below ground. There are many recent examples including in 2016 when Sydney light rail was delayed due to the discovery of 400 disused utilities in the CBD.

It is important that civil contractors are aware of these exposures and the contractual options available to them prior to executing a contract.

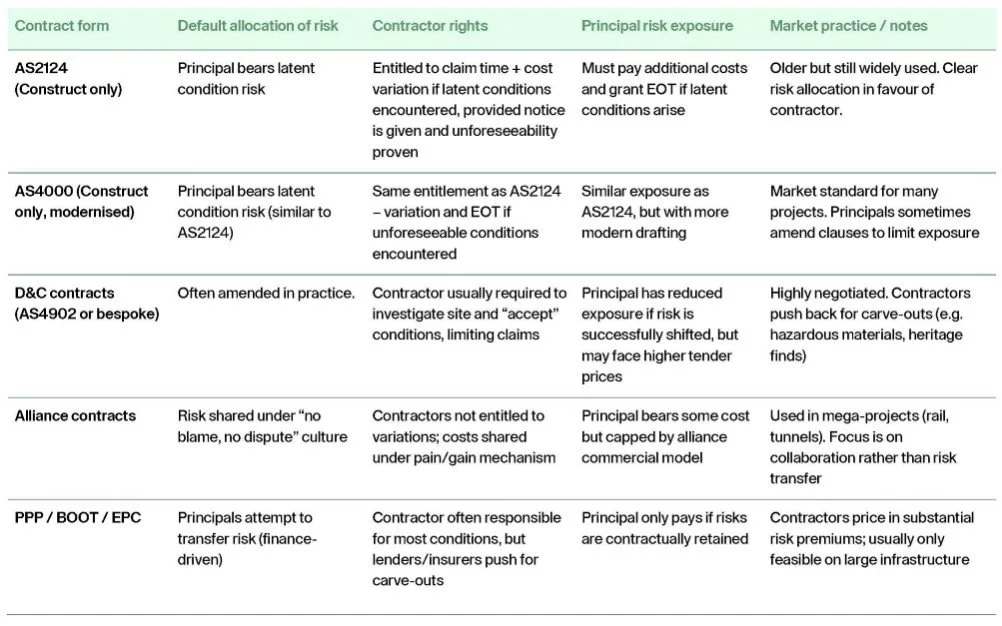

Contracts

Commercial realities

In the first instance it is best to push back on the acceptance of these risks (whether you are a contractor or a principal) however this isn’t always a commercial reality. So, the questions becomes… “if I have to accept, then how do I mitigate the risks internally?”

Mitigating the risk – tender phase

Has enough information been provided to be able to price the risk accurately?

A complete and comprehensive review of the geotechnical reports, site surveys, and utility plans must be complete to then be able to identify the gaps in data. Where uncertainty exists, assumptions should be clearly documented and clarified during tender queries.

If uncertainty cannot be clarified, then allowances or contingencies must be built into the program and pricing. These may take the form of:

Provisional sums – agreed upfront to address unknowns.

Contingency allocations – internal buffers in time and budget.

Exclusions and clarifications – expressly set out in the tender submission to avoid later disputes.

Mitigating the risk – post award

Once the contract is awarded, attention shifts from pricing to active management. At this stage, risk mitigation hinges on:

Early works and site investigations: front-loading investigative works (trial pits, boreholes, service proving, and ground-penetrating radar) to confirm conditions before bulk construction begins.

Design risk management: ensuring that design consultants are engaged early and held accountable for the accuracy of their inputs.

Stakeholder engagement: working closely with utility providers, authorities, and landowners to resolve conflicts before they impact the program.

Transferring the risk – insurance

There are some instances where principals and contractors can then transfer this risk off their balance sheets via insurance. Refer to the risk matrix below for details:

Transferring the risk– downstream

An equitable and fair allocation of risk is always in the project’s best interest. However, as this might not be achievable the next best option would be to ensure that you have a robust and comprehensive subcontracting regime, to then pass on the risk downstream. At Bellrock advisory our experts and legally trained advisors support our clients in achieving this.

Conclusion

Clients should be aware of the dangers of accepting latent condition risk. Assumptions or gaps in information can cause time delays and cost blow-outs if they’re not actively managed. The most reliable defence is layered:

Allocate the risk fairly in the contract and record clear assumptions at tender.

Reduce uncertainty early through targeted investigations, service proving and accountable design inputs.

Run tight post-award controls—notice, records, stakeholder coordination.

Partner with an experienced risk advisor like Bellrock to transfer risk off your balance sheet where possible, supported by wordings that fit the project.

Accept that some exposures are uninsurable and must be priced, programmed, or subcontracted downstream with clarity.

Done well, this approach lowers disputes, keeps projects moving, and protects margins without paying unnecessary insurance premiums.

If an entirely “equitable” allocation isn’t commercially achievable, discipline in assumptions, contingencies and subcontract flow-downs is the next best way to keep the project bankable.

Bellrock Advisory can help test your allocation, tighten your mitigation plans, and structure the insurance programme so that it responds effectively in the event of a claim, when it matters most. Contact a Bellrock Advisor today.

This article was originally published as part of Bellrock's library of risk trending articles here.

Author: Alex Cox, Practice Leader, Bellrock Advisory

Bellrock is a national risk advisory and advocacy firm with a specialisation in risk management and insurance for the construction industry. Discover more about our unique methodology here.