Architecture

Michael Bialek - SJB Architects

“2020 was a challenging year but reminded us all of what is important in everyday life. 2021 will see our team return to the studio and respond innovatively to the changing conditions in the property market.”

Building Surveying

Shane Leonard - Phillip Chun & Associates

“2020 taught us that even the building consultant industry can work remotely and has the ability to adapt. 2021 looks as though the construction industry’s recovery will be quicker than expected. However, it will be garnished with a healthy dose of caution.”

Construction

John Crane - Alfasi

“2020 was a year of reflection and re-setting of expectations. I predict that 2021 is a dynamic year of change with both positive and negative outcomes for the property market.”

Development

Guy Taylor - Digital Harbour

“2020 has required all of us, including the property industry, to pivot quickly. The key take away for me from 2020 has been ‘maintain great relationships’. Not only on a personal level (being confined at home) but also on a professional level with colleagues, tenants and clients. It could have been either negotiating rent relief, a design issue or an alternative playground for a 3 year old. That being said these challenges have certainly presented new opportunities in the property industry - it has allowed us time to consider how to reposition assets or reconsider designs to meet future demands. The ability to respond quickly to the ever changing demands of the market will be the key to 2021 along with maintaining great relationships.

2021 is going to be an exciting year and I believe there will continue to be opportunities in property for those who can pivot and adapt quickly. We will have the opportunity to have the social and personal interactions we have all been missing. I hope the lessons of 2020 will see the streamlining of bureaucratic processes and a focus on enabling outcomes not only to improve of health of all of us but also that of the environment which will allow our great city of Melbourne to be the vital and exciting place it is. I hope we will see a focus next year of improving public spaces which will inherently improve property values.”

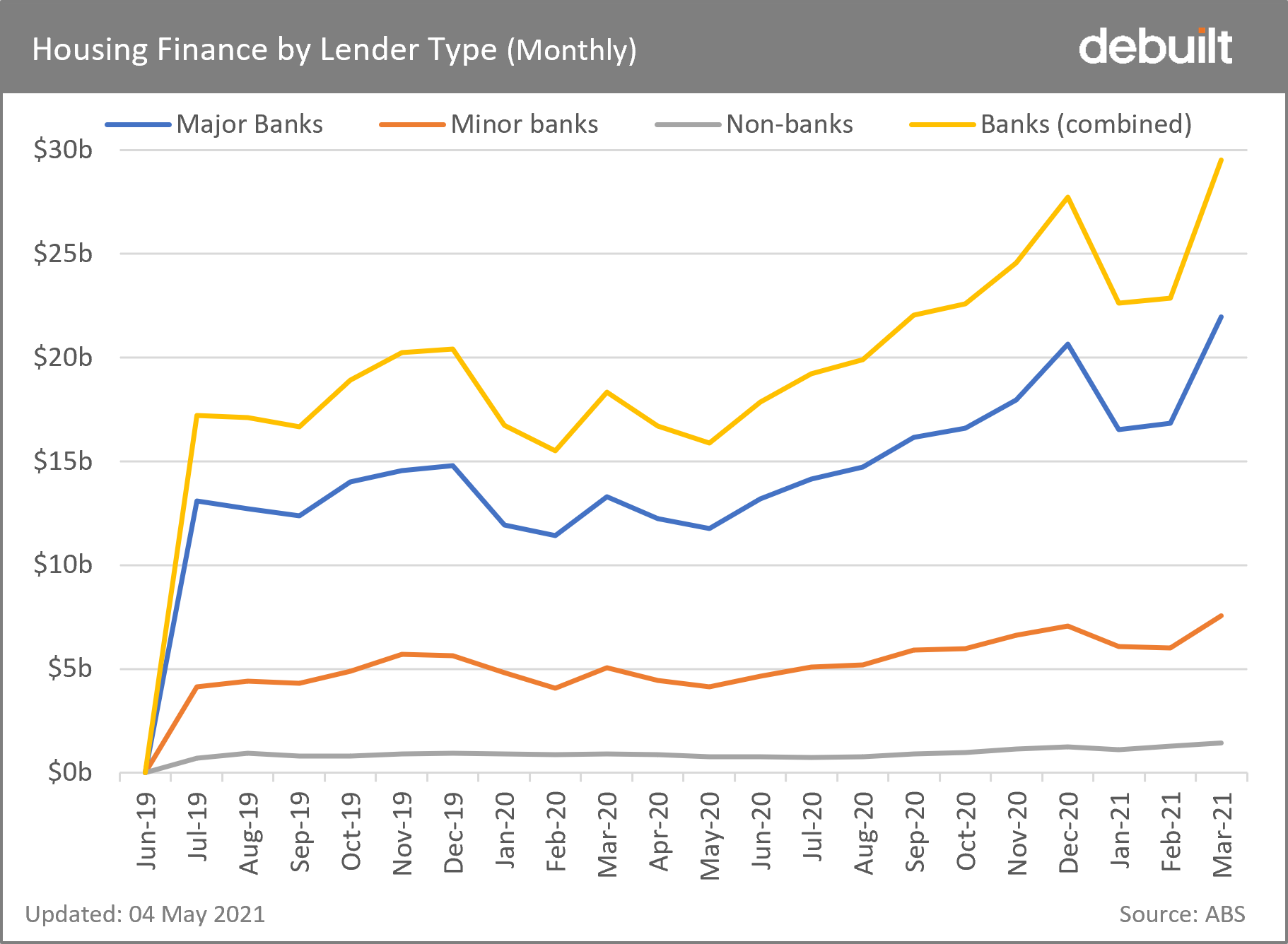

Finance

Kathy Johnson - Yarraport

“2020 has been a volatile year and property capital markets have been no exception, seeing a strong shift in appetite towards more “COVID-safe” assets such as industrial, medical and medium to low density residential.

We expect 2021 to have continued growth in non-bank capital providing competitive tension for borrowers, and activity growth with the delivery projects from both pent-up and pulled forward demand from lockdown and government stimulus.”

Fiona Clark - Merricks Capital

“The resilience of the property market in 2020 has surprised many. The strong rebound in sentiment and continued fiscal and monetary stimulus should limit downside, but risk factors have also intensified.”

Neil Slonim - Slonim Consulting

“2020 has been a year like no other. No one could have predicted what would unfold. Whilst many have been, and will continue to be, adversely impacted, this ‘Black Swan’ event has spurred learnings and creativity which is already generating new opportunities for well-managed and reputable developers, investors and lenders.”

Project Management

Josh Whiteley & Tynan John - APP

“2020 was challenging for most, some more than others, but everyone came together and we got through it - which now provides a great base for the next phase of growth/opportunities. 2021 will see the implementation phase of industry shifts that were in afoot, but are now accelerated, being more social housing, build to rent rise, mixed use on top of retail, WFH & more work being done from non-‘CBD traditional office block’ locations.”

Property Law

Michael Fetter - Tischer Liner FC Law

“2020….interesting year as property was meant to be depressed, but was resilient with low rates and opportunities. There were very little mortgagee in possession sales, and lots of mezz lending deals.

2021…while no one can foretell the future, trends seem to be de-centralising from Melbourne CBD, build to rent, holiday house acquisitions, smaller developments of townhouses and lifestyle apartments. Office market rents will fall, incentives to lease to rise, and residential rents will continue to be under pressure until students return.”

Briget O’Callaghan - marshalls+dent+wilmoth lawyers

“2020 saw Melbourne’s commercial and residential property market slow down, however the overall outcome was not as bleak as anticipated.

Developers’ access to finance for construction projects was harshly affected by cautious and risk-adverse lenders. The risk and reality of being unable to meet milestones and deadlines due to unexpected delays was also a concern for many developers this year.

Property prices held steady regardless - we saw an increase in first-home buyers return to the market in the second half of 2020, taking advantage of various State and Federal government grants directed their way.

The property market outlook for 2021 is uncertain, however this uncertainty creates some opportunities within the property market; Victoria’s 2020/21 budget focused on stimulating the property/construction sector with affordable housing opportunities. opportunities for developers and provide much needed relief to some of the more vulnerable members of Victoria with many projects tipped to begin early next year.”

Jane Hodder - Herbert Smith Freehills

The year 2020 has certainly been a challenge for us all, especially in the commercial office, residential apartment and retail sectors. There has also parts of the property sector which have benefited from market conditions during 2020 such as industrial. It is therefore more important than ever for real estate players to pre-empt some of the future trends that will emerge from 2020 so that they can be ahead of the game in both taking defensive positions on risk areas and pursuing new opportunities.

With the deferral of many transactions during 2020, especially in the commercial office and retail sectors, there is likely to be a significant uplift in activity in the first half of 2021. Despite the pandemic’s devastating impact to lives and livelihoods of so many people, senior executives also highlighted that through disruption, opportunities arise. The road ahead does not come without its challenges though which the property industry will need to navigate during 2021.

Real Estate — Commercial

David O’Callaghan - O’Callaghan Commercial

“2020 saw decades of property and contract law thrown under the bus as Government decided pandemic survival was only about tenants. 2021 is likely to see the beginning of a long, deep and very painful journey for owners and investors forced into a post-Coronavirus hangover and a platform where they hold a significantly weaker hand.”

Paul Burns - Fitzroys

“2020 saw appetites for secure, long-term assets increase, with tenants who can and will pay rent being in demand. The long term affect on assets will be modest - people need the collaborative and social environment of an office, and employers need to see what their employees are doing. Now, more than ever, productivity will need to be driven to catch up for the losses.”

Raoul Salter - Gross Waddell

“2020: The challenges of 2020 have been well documented but as expected, the resilience of property has been on display, bouncing back well.

2021: A crystal ball gazing approach sees a brisk start with possible head winds as the year progresses. A vaccine can’t come quickly enough!”

Jesse Radisich - Savills

“2020 was clearly an extraordinarily tumultuous year for all of us and within the property market. It was a year of contrasts, with an exceptionally strong start to the year brought to a sudden halt by the onset of the pandemic. It was then a period of consolidation and caution, followed by a period of strong activity and optimism throughout the second half of the year as the virus unfolded and we managed to get it under control.

2021 is shaping up to be an exciting year. We anticipate the confidence and optimism currently running through the market will roll over into the new year, and we expect strong activity early on in 2021. The big question is whether this will be maintained throughout the balance of the year, and the hope is that with interest rates at rock bottom levels, plenty of cash in the market, big Government spending, the proposed vaccine rollout and then subsequently tourism and migration returning, we may just be able to cushion ourselves moving forward.

Recruitment

Rohan Christie - Kingfisher Recruitment

“2020 broke the crystal ball, but it was pleasing to see how resilient our local community and economy has been throughout this tough period. We have never been busier in December, which is a great sign for what is to come in 2021, although questions remain to be answered about drivers like immigration.”

Retail

Mark Upton - Coles Property Group

“2020 - A year to forget; one which further accelerated trends toward reduced retail floor areas in favour of logistics and dark stores for online ‘Click & Collect’ options.

2021 - I am predicting a slow recovery to a new ‘normal’. There is an opportunity to capitalise on work-from-home learnings and forced innovation in the repurposing of existing structures. State-sponsored investments in affordable/public housing and infrastructure looms as a potential saviour for the construction industry.”

Town Planning

Deon White - Roberts Day

“2020 was global dose of what’s important and reminder of humanity’s ability to adapt. 2021 will reward innovation, driven by the need to nimble and the opportunity in shifting community values.”

Kellie Burns - SJB Planning

“2020 gave us a reset we couldn’t have imagined possible (or that we would have desired) and forced a seismic creative re-think of how we do business and relate to one another – hopefully for the better! 2021 will see a return to property activity, with 2020’s insights guiding decisions across all sectors of government and private interests particularly relating to how we live, where we work and how our public spaces can enrich us.”

Valuation

Scott Keck - Charter Keck Cramer

“The impact of COVID-19 was not as severe as most commentators were suggesting. However, as the pandemic fades, we will return to some of the pre COVID-19 economic challenges of under-employment, stagnant wages and low inflation and productivity. On a more positive note, support for the residential markets is on the horizon, with the inevitable return to the appropriate rates of population growth boosted by immigration mainly from Asia, including China, and the return of foreign students.”

Debuilt Property

Danny Burger & Paul Abrahams

“2020: The Debrief, with its bespoke cartoons, was meant to generate a smile but each week seemed to deliver more bleak news. Having said that, COVID did not have the devastating impact on the property industry many of us feared. Rather many of us gave up hard copy files, became more mobile, advanced our IT skills, got better acquainted with the people in our household and are now convinced that greater flexibility in our work methodology is achievable.

2021: We are creatures of habit, and barring a new pandemic hitting us in close succession, we will mostly revert to a modified version of past practice. Collaboration, socialisation, strategy, mentoring and relationships are best achieved in person. However our lessons from 2020 will create exciting and innovative design options that will emerge in our built form.”

![190815_AMPCapital_ShaneOliver_715[66].jpg](https://images.squarespace-cdn.com/content/v1/5c197a32b105982976e5e89b/1619054377539-39PFJHMNFUQFNYFQ9WWI/190815_AMPCapital_ShaneOliver_715%5B66%5D.jpg)

![TSK+-+no+background[1].png](https://images.squarespace-cdn.com/content/v1/5c197a32b105982976e5e89b/1607484271733-GLE5P6DRQB9YKPT0SK35/TSK%2B-%2Bno%2Bbackground%5B1%5D.png)